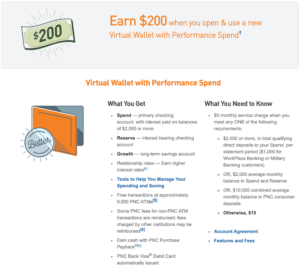

PNC accountholders have access to 9,000 ATMs that are free to use. You’ll have to use either your debit card or PNC Visa credit card to make at least five purchases or set up a monthly direct deposit of at least $500 if you want to snag a slightly higher relationship rate of 0.02%-0.03% (depending on your balance) on your Growth account, otherwise the Growth account will also only earn 0.01%. Your Reserve account earns an APY of 0.01%. You can be rewarded with a $50 bonus if you open and use a Virtual Wallet account. Make $500 in monthly direct deposits to your Spend account.Maintain a $500 combined monthly average balance in your Spend and Reserve accounts.You can drop the fee if you meet one of three criteria: The Virtual Wallet has a $7 monthly maintenance fee. Not all products and services are offered in all locations. Products and rates can vary depending on where you live. Growth: This is a savings account for long-term savings, also with no minimum amount required for opening.You must keep at least $1 in your account for it to earn interest, but there's no minimum amount required to open one. It’s designed for short-term savings goals. Reserve: This is an interest-bearing checking account.The minimum amount to open an account is $25 but it drops to $0 if you open the account online. Spend: This is a regular checking account that might earn interest, depending on the Virtual Wallet account.

PNC uses different lingo to brand its deposit accounts just as Starbucks uses different words for its beverage sizes. It includes three accounts that are packaged together. The Virtual Wallet is PNC’s basic account with a handful of features. PNC's online-only offerings in states where it doesn't have branches are actually better than those in the states where it does have brick-and-mortar locations.

Harder to open a stand-alone account: PNC takes a slight departure from standard banking products in how it packages its deposit accounts.Wide range of products and services: PNC offers everything from student loans to auto loans to wealth management to life insurance in addition to deposit accounts.This might include being reimbursed for several specific ATM fees per statement cycle or receiving up to a certain amount in ATM fees back. ATM fee reimbursement: You can either have your non-network ATM fees reimbursed or have them dropped altogether depending on which type of deposit account you sign up for.You can earn either $50, $200, or $400 when you sync your account with a qualifying direct deposit, or other by meeting other requirements, depending on the type of account. Sign-up bonuses for deposit accounts: Sign-up bonuses are more common with credit cards and business accounts, but PNC offers one when you open a Virtual Wallet.

0 kommentar(er)

0 kommentar(er)